Avast! There are 2 versions of this article. Choose wisely!

Last year, I published two short notes speculating on the provenance of the Banana Gun Bot team.

The posts mapped the on-chain flow of funds that went into creating Banana Gun Bot and, I would argue, raised certain troubling questions about the kind of devs that created it. When the antecedents of the anon developers of a leading trading bot appears questionable, the question might follow, for whose benefit does Banana Gun Bot operate?

10 months is a long time in the microcap universe. To be fair, it is a long time in DeFi at large. I sat down to take stock of how right (or wrong) I was about the Banana team. What I discovered goes deeper than I had initially imagined – and throws up questions for the future of how Ethereum operates.

To set the stage, let us first consider some numbers.

Since May 2023, TG Bots have been accepted in the DeFi ecosystem as a business model that has come to stay, contributing heavily to daily on-chain trading volume. Over the last year, TG Bots have been generating anywhere between 20% - 30% of the total transaction volume on Ethereum, in sheer transaction count percentage. All TG Bots put together are the source of 9.4% of the trading volume on Ethereum as of June 2024, and originate transactions from nearly 5.3% of all Ethereum wallets. Thus, TG bots like Banana have now become significant transaction originators on Ethereum and consequently, have themselves become players in the Ethereum ecosystem.

Since June 2023, at least $5.25 billion worth of capital has moved through the Banana Gun routers. Granted that a portion of this was on Solana, but this puts Banana third only to Maestro (the first mover in the category with an edge of over a year against its competitors) and Bonk Bot (touted by narrative peddlers as a bet on the entire SOL shitcoin ecosystem).

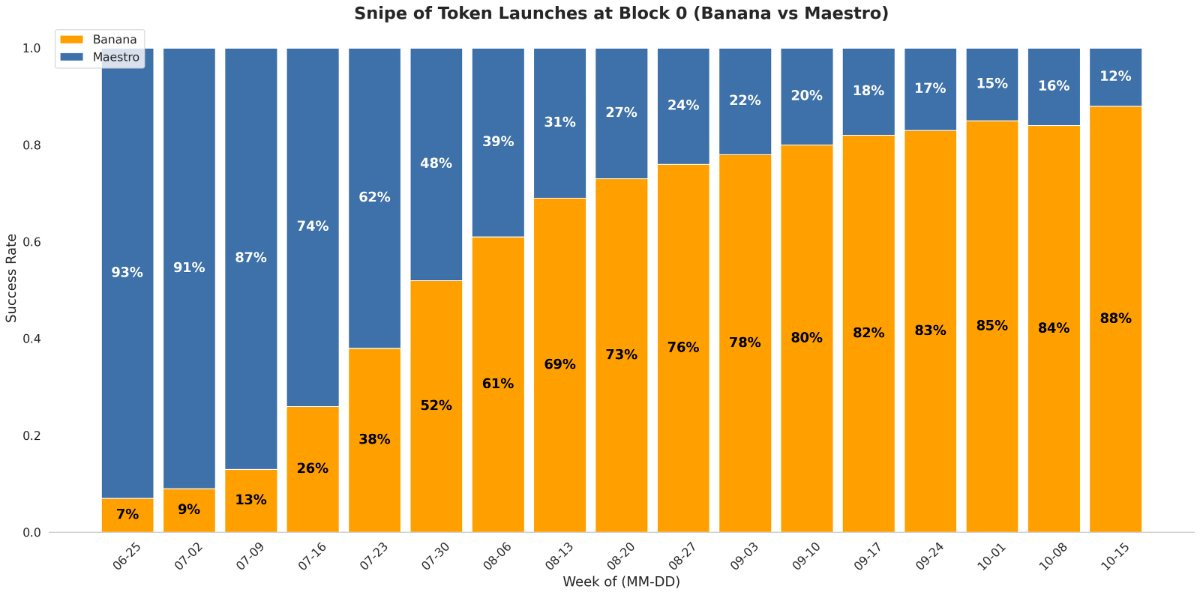

Observers in the space have watched the pace at which Banana captured market share, with a certain amount of confusion. The primary catalyst in building this crushing dominance was the success rate of Banana Gun Bot’s sniping bundles. Early on in its existence, Banana distinguished itself as the bot to use if you want to snipe, not just trade. And when it comes to trading shitcoins which typically have a life cycle of just a few hours, getting in first at ‘Block 0’ is often the only thing that matters.

So effective was this Banana Gun tactic that, between June - October 2023, when compared with the industry leading TG Bot ‘Maestro’ (operational since mid-2022), Banana Gun users went from 7% ‘Block 0’ dominance to winning a definitive 88% of the first bundles in the TG Bot space.

A new market reality was created – one where the ordinary shitcoiner sets himself up for failure by using any of Banana’s competitors. If you wanted in first, you had to join a Banana Block 0 bundle. A culture of paying high bribes was created within the Banana user base, which initially came to be derided on CT, but this situation was soon accepted as fait accompli.

In fact, the high bribe culture of Banana users came to be touted as a marker of its commercial success and an indicator of value to the $BANANA token holders. Of course, one aspect of the bribe culture within Banana users is that it is a PvP situation even within its bundled transactions, with its deep pocket users getting into tokens first and smaller bribers serving as the exit liquidity for leading Banana users themselves.

Even by the Banana team’s own admission, the bot was originally created by its devs for use within a close circle of ‘friends’, but was then opened up for public use because, clearly, its dev team is votary of degen communism.

It deserves mention here that the allegation of Banana team frontrunning its own users by monitoring their bribes has never been dispelled till date. Regardless, it is the second facet of Banana Gun Bot’s snipe bundle dominance that is beginning to snowball into somewhat of a case study for the entire Ethereum ecosystem.

PROPOSER BUILDER SEPARATION

When the Edge Becomes Status Quo

In September, 2023, the Banana Gun Bot team launched the $BANANA token, which promised a 40% rev-share from the revenue generated by the bot from its users. By November 2023, Banana Gun Bot was securing more than 90% of all Block 0 snipes, standing head and shoulders above its competitors in adoption and revenue generation. According to a source, by December 2023, the Banana Team executed a master stroke. Having normalized a high bribe culture in ETH shitcoin trading, Banana used its Block 0 dominance to exploit a long theorized but then unrealized systemic weakness in Ethereum that brilliantly transformed its early lead in the TG Bot market into an economic moat against competitors.

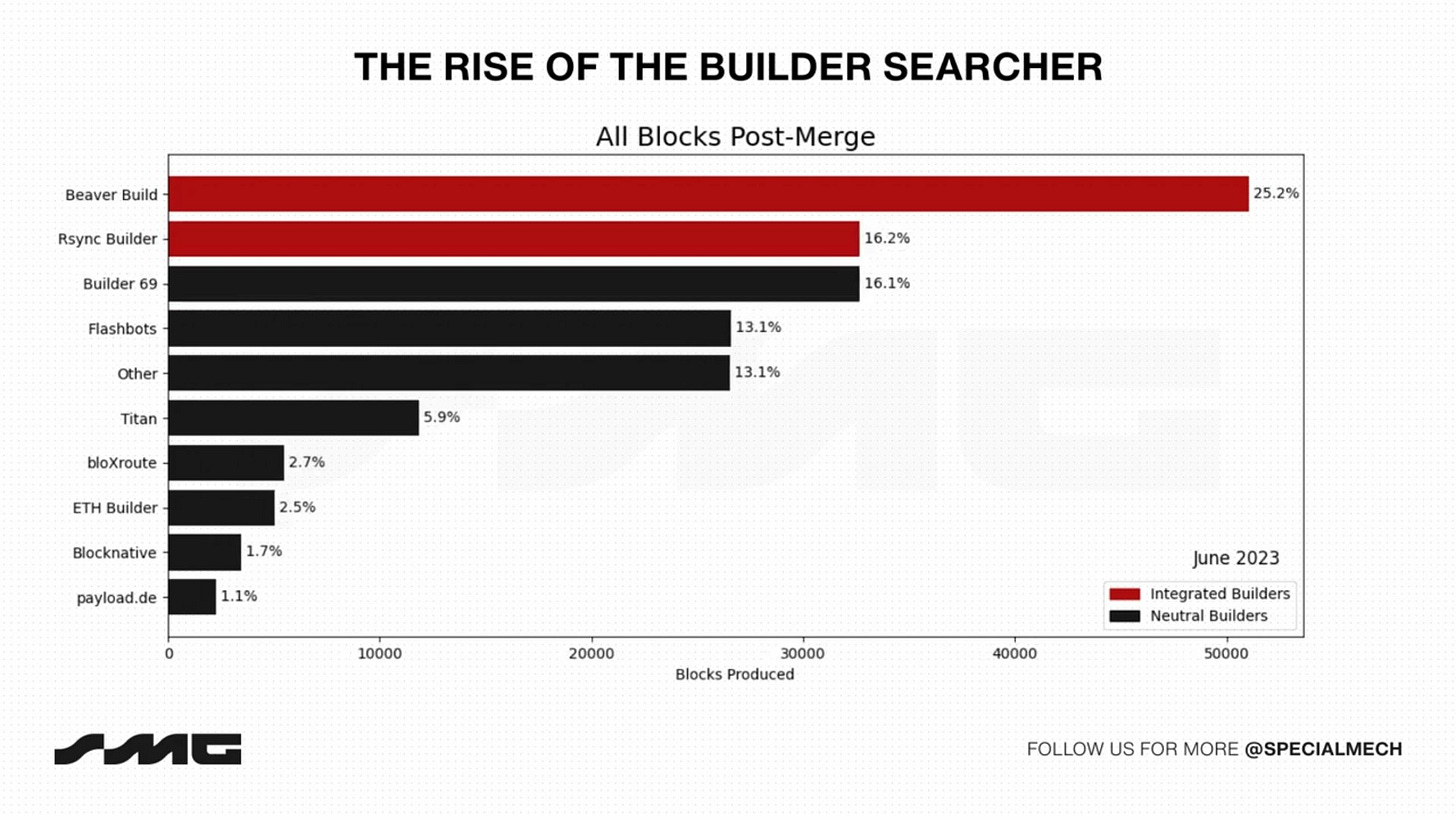

Ordinarily, in a healthy and competitive block building market under PBS, transactions originated by the TG Bots would be available to various Builders. In the best case scenario, in an open competitive bidding process, the Proposer earns the highest possible fees by picking the best bid from competitive Builders. The issue is that this competitive nature of the block building market can be truncated by multiple factors. One was pointed out last year by the Special Mechanisms Group in its paper Centralizing Effects (Gupta, et al., 2023), where they demonstrated that, over time, a small group of sophisticated builders would come to naturally dominate PBS. Interestingly, they theorized in May 2023 that this centralizing tendency primarily arises from ‘top-of-the-block’ opportunities such as CEX-DEX arbitrage.

Notably, SMG suggested that the advantage in PBS top-of-the-block opportunities would be cornered primarily by builders who had ‘rumored connections with High Frequency Trading firms’ such as Manta, Rsync Builder and Beaver Build. In contrast to these HFT firm-backed builders, the SMG team also analysed Blocknative, Builder69 and Flashbots as other high volume but non HFT builders, proving their hypothesis. Ironically, SMG refers to Titan Builder’s June 2023 paper which demonstrated that these top Builders had more order flow submitted to them by transaction originators that resulted in them dominating PBS Auctions.

An important conclusion drawn by SMG was that ‘Builders who earn more from the top of the block, will be willing to pay more for private order flow, since they need to win the whole block in order to exercise their top-of-block advantage’. Thus, SMG visualized a situation where sophisticated, HFT-firm funded Builders could develop a monopoly in PBS if such builders also acquire private order flow to cement their lead. In doing so, they would suffocate smaller builders – just like Titan Builder mused in its own June 2023 paper (young Titan’s public RPC went live only on 17.04.2023).

At the outset, it is a fact that TG Bots offer users the service not just of sniping, but also ordinary buy and sell transactions, including limit orders on-chain. The business model of Banana, however, is primarily rooted in its ‘sniping’ narrative. Its culture of outrageous Block 0 bribe bundles drives its robust revenue stream. Therefore, the Banana business model is predicated on guaranteeing its users that they will enter a token trade before any competitor. Ordinarily, to maximize the chances of the Block 0 bribe bundle landing on-chain, such an originator would send its users’ bundle to all leading builders on Ethereum. Logic suggests that when a TG bot sends its bundles to multiple Builders, it maximizes the chances of that bundle being made a part of the winning block and landing on-chain because the Builders are competing with each other to ensure that their respective block gets accepted by the Validator.

On the other hand, sending exclusive order flow (EOF) to a single builder means that builder has to land the order flow (spiced up with bribes) on chain. Any delay defeats the edge – the bundle wouldn’t be a snipe anymore. Therefore, an originator like Banana should ideally offer order flow at least to a builder that demonstrably has the highest inclusion rate on chain. From SMG research at the time when Banana launched, it is fairly clear that builders such as BeaverBuild and others backed by well capitalized HFT firms would therefore be the ideal recipients of such EOF from Banana. But the Banana Team chose otherwise, as we shall see further down.

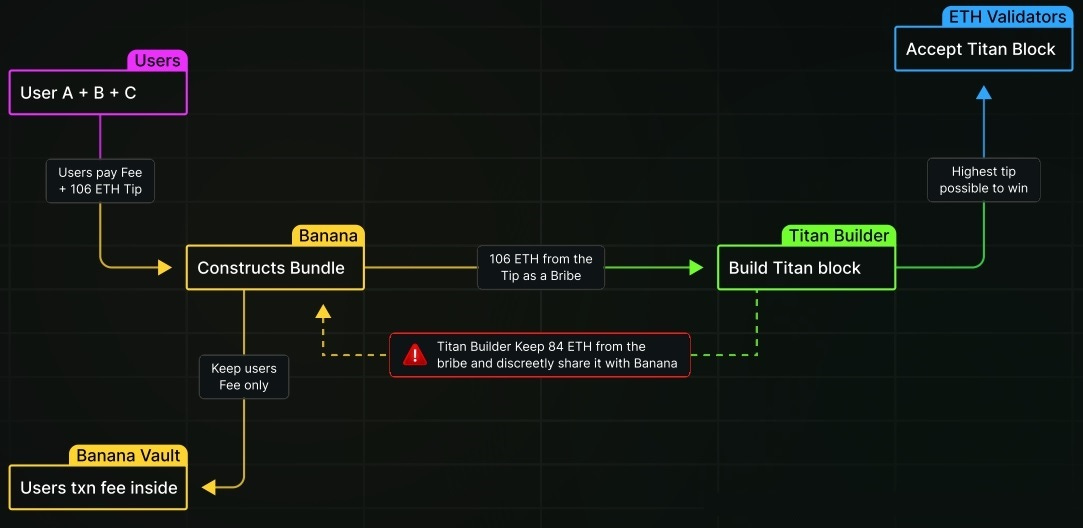

A collateral impact of dedicated Banana order flow to a Builder would be something as follows.

When high bribe bundles are sent exclusively to a given Builder, the other Builders do not have access to that bundle, and therefore its bribes. The rational strategy for the ‘chosen’ Builder is to incrementally outbid its competitors to ensure that only the least amount of money has to be paid forward to a Proposer in order to land the bundle on the next block. Thus, if a Block 0 bundle with a 5 ETH bribe is routed via EOF, and the highest block bid at that moment from a rival Builder is 1 ETH, the exclusive Builder can bid "just enough" to secure the block (say, 1.1 ETH ) and reserve the balance 3.9 ETH for itself as pure profits.

What could the Banana team stand to gain from offering EOF to a single Builder? The answer lies in potential kick-backs from the profits that such a Builder delivers. This EOF agreement means that the Builder could send a portion of your bribes back to Banana (as payment for EOF), which therefore now earns not just from transaction fees, but also from the high bribe culture it has generated amongst its own users. This isn’t a novel business model – US based Robinhood Markets was famously paid hundreds of millions of Dollars by Citadel for ‘payment for order flow’.

Q. Has the Banana team made public the existence of such an EOF arrangement?

A. No.

Q. As the issuer of the $BANANA token and custodian of the project’s treasury, has the Banana team redistributed the overpaid bribes back to its users or to $BANANA token holders?

A. Definitely not.

Q. But more importantly, in 2023, did the Banana team execute its EOF arrangement with the Ethereum builder with the highest market share in block building, to ensure in good faith the best chances to its users of placing their bribed Block 0 bundles on-chain?

A. Curiously, no.

BACKROOM DEALS IN THE DARK FOREST

Analysis of transactions from the Banana Gun routers reveals that, barring certain periods, the Banana team routes its snipe bundles exclusively through Titan Builder.

Titan had started off in April 2023 with a PBS block building market share of 1%. When the Banana team started directing EOF to Titan, the latter lagged far behind other Builders in the PBS market. With that as a jumping off point, it is remarkable to note that in the 7 days preceding the publishing of this article, Titan has contributed nearly 40% of all Ethereum blocks.

In short, within a year, Titan has come to be

the second largest Builder on Ethereum and

the most profitable Builder in the Ethereum PBS landscape, both owing in no small part owing to the EOF directed towards it by the Banana Gun team.

A close look at the data in the graphic above from libMEV reveals the real scale of Titan’s success. Beaverbuild is the leading block builder on Ethereum post PBS. Since the Merge, it has built over 1.2M blocks, resulting in Ethereum Validators earning 146,241 ETH as a result, while generating 14,520 ETH profit for Beaverbuild in the process.

Take Flashbots builder as another example – over 552.8k blocks delivered, with 16.7 ETH pocketed as profits while passing on 58,349 ETH to the Ethereum ecosystem by way of its Validator Fees. On the other hand, we have Titan – that has delivered 615.2k blocks since May 2023, but already pocketed 13,151 ETH as profit, while passing on 60,912 ETH to the ETH ecosystem.

In doing so, Titan has pocketed nearly 787x the profits of Flashbots builder, while delivering slightly more by way of blocks built. Similarly, while Beaverbuild has retained about 9% of the ETH paid by users for blocks built by it, Titan has already pocketed 17.75% of such ETH as its own profits, having built less than half of the blocks delivered by Beaverbuild!

An excellent recent paper published by Markovich (May 2024) delves quite deep into this arrangement. She takes the example of Block 19728051 (referred to as Block 8930981 in the paper), where the Block’s total value was 76.38 ETH, total priority fee was 4.54 ETH and the total bribe paid to Titan was 72 ETH.

Sarit remarks that in Block 19728051, the proposer Lido was able to earn only 19.75 ETH from the block, whereas Titan was able to retain 56.6 ETH as pure profits through its EOF arrangement with the Banana Gun team.

Sarit analyzes 181,651 blocks between April 6, 2024 to May 5, 2024. Of course, she studies both Banana and Maestro, but the latter team is irrelevant to the present article to the extent that it doesn’t have a token, and doesn’t promise token holders any benefits or profits in staying invested in its ecosystem. She reports that out of the total block value in her dataset of 21,406 ETH, only 17,127 ETH has been passed on to the Ethereum ecosystem via its Proposers. Thus the Proposers have lost out on 4,279 ETH during this short period. Specifically, Lido itself was not paid 1,666 ETH in the single month of this dataset.

This paper buttresses my own back-of-the-envelope calculations in reviewing over 3500 blocks on Ethereum chain between December 2023 and March, 2024 where Banana Block 0 bundles were routed almost exclusively through Titan Builder. This reveals that out of a total of 4466.89 ETH paid by Banana users to get their snipes on chain, only 2915.65 ETH was passed through to Ethereum Proposers and 2271.26 ETH was cornered by Titan Builder. Even assuming a 50-50 split in the private EOF between Banana and Titan, it would stand to reason that 1135.63 ETH was sent back to the private coffers of the Banana Gun team during this period. These would have been undeclared profits running into the Millions of Dollars, extracted from unwitting users who were goaded into a high-bribe culture by the Banana Gun team to begin with.

And so, the monkey business continues.

THE IRONY OF IT ALL

Whither Cypherpunk?

I dipped my naïve toes into DeFi years ago, eyes agog at the wondrous possibilities of what could be constructed in a system that was decentralized and permissionless. I am admittedly a romantic. To me, the open, public culture of the blockchain offers a compelling path towards building a better future for all.

I also dabble in shitcoins that make me chuckle. There’s a dash of cynicism which coexists with idealism in my moral universe. Having said that, I do think memes should be consigned to being a fun corner in an otherwise rich tapestry of blockchain development. I tend to agree with Vitalik when he says,

“Degen gamblers can be okay in moderate doses… But when they are the largest group using the chain on a large scale, this … leads to many of the other negatives that we have seen play out over the last few years”.

On the other end of the spectrum, we witness the enthusiastic participation of sophisticated financial actors. A few years ago, there was reportage about how Jane Street HFT firms hired Physics graduates. Similar trends have created a situation in crypto where giga brains stopped splitting the atom and looked to split the block. This is inevitable in a market that presents opportunities to extract exhilarating sums of money. Before the Merge, Miners had a central role in securing PoW Ethereum. But as TradFi strategies were deployed on-chain through arbitrage bots and gas-wars, we saw the rise of ‘MEV’ – with attendant risks. The Flash Boys 2.0 paper warned that ‘DEXes in fact present a serious security risk to the blockchain systems on which they operate, i.e., at the consensus layer.’.

Another concern was that large Miners could come to control transaction ordering on-chain. This warning was taken seriously – Proposer Builder Separation was the solution, even while acknowledging that this solution was partial and prone to centralizing tendencies. After all, while building permissionless spaces, one has to presume that its participants aren’t charitable – indeed, one has to provide for the certainty that they will be self-seeking to the detriment of others.

Paul Dylan-Ennis refers to Ethereum’s 3 leading sub-cultures - ‘Cypherpunks’, ‘Regens’ and ‘Degens’. His definition of ‘degen’ is relevant - ‘a contingent of users driven purely by speculation and wealth accumulation at all costs’. According to Paul, Degens can typically be found milling around shitcoin and NFT launches in DeFi. But these aren’t the only type of Degens on-chain, in my opinion.

Vitalik also problematizes this definition, pointing out that ‘degens’ aren’t a homogenous, coherent group - to wit, ‘institutional profit-oriented groups and people buying pictures of monkeys are very very culturally different.’. But both can be degen in the way Paul defines them - ‘wealthy accumulation at all costs.’.

Even Builders on Ethereum can be Degens.

In the first year of PBS itself, substantial research revealed that HFT firms had deployed optimized extraction algorithms to secure a higher return per block built. Ecosystem participants whispered that certain Builders had connections with HFT firms and research suggested that their edge in sophistication rendered them new centralization threats to Ethereum. It may be that these centralizing tendencies cannot be eliminated. It may be acceptable that well funded and sophisticated Builders dominate the market, as long as other Builders (with potentially better tech) find it possible to enter the market as alternative service providers. But at some stage, this tendency can threaten the very system upon which it is built. Kilbourn (2022) posited that EOF coupled with the centralization in PBS could create such high entry barriers to the market that new, even potentially better Builders, find it impossible to enter the market. EOF can also create a situation where the ‘chosen’ Builder corners the market, rendering other existing builders financially unviable.

The above image suggests that this is exactly what has happened in PBS over the last year, since TG Bots came into existence and more particularly, Banana Gun executed its EOF arrangement with Titan. While Beaver Build and RSync continue to steam ahead, others amongst the top 10 appear to be struggling with the fallout of Titan’s rapid rise. If existing Builders eventually drop out of the PBS market because they are loss-making and new Builders cannot enter because the bar is set too high, the decentralization and credible neutrality of Ethereum’s ecosystem is placed under serious threat.

To me, the irony of the situation is that Ethereum’s credible neutrality is under threat from degens.

Permissionless access to a global settlement layer naturally generates all kinds of trading. As the numbers reveal, shitcoin trading has become a significant driver of this volume. TG Bots as an industry cater almost solely to this category of traders, and the Banana Gun team, despite its dubious history, has become successful enough through its EOF arrangement to become one of Ethereum’s biggest threats, today.