Proposer Builder Separation on Ethereum

A Brief Note for Smooth Brains Like Me

Prior to the Merge, the concept of ‘Miner Extractable Value’ alluded to the fact that Ethereum PoW miners could, by exercising their power to include, exclude and order transactions in a particular epoch, extract profits in the form of ‘ordering optimization’ fees [Flash Boys 2.0, Philip Daian et al]. In and of itself, because ‘only a few dozen or few hundred nodes can afford to run a fully participating node that can create blocks or verify the existing chain’ [Endgame, Vitalik], block production/building always had a high cost of entry. This power of the well capitalized Miner to extract value from transaction senders threatened to create a strong centralizing force in the Ethereum ecosystem to the detriment of all other participants.

A potential alternative was suggested in the form of ‘Proposer/Block Builder Separation’. Under PBS, block builders generate "exec block bodies," which are basically a list of transactions to be sent to the blockchain with a fee for the proposer, and the proposer chooses the bundle with the highest fee. The simplicity in discharging its role by accepting the bundle with the highest fee and not having to actually produce a revenue maximizing bundle for themselves makes it less capital intensive to become a Proposer and allows block validation to be potentially far more decentralized than block building, under PBS.

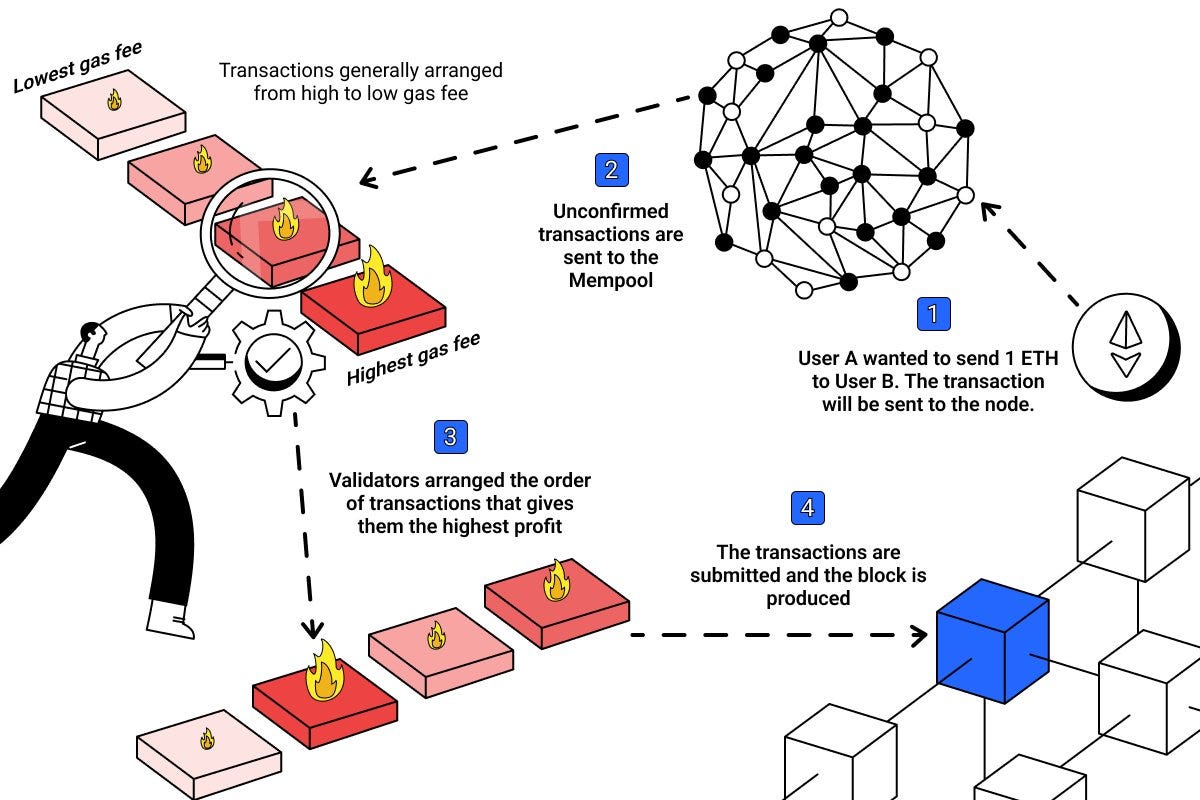

But Merge didn’t destroy MEV, it merely displaced its location. Earlier, the power of the validator (‘miner’) in guaranteeing transaction inclusion and ordering was used by it to extract MEV from user transactions. PBS (with MEV Boost) basically generates an auction market where builders negotiate with validators ‘selling’ blockspace to the highest bidder. The transaction ordering and inclusion now lies in the hands of Builders, who can extract MEV for themselves and bid just enough to Proposers to guarantee the inclusion of their blocks. The following image gives you a basic idea of how PBS operates to get your transactions included in the Ethereum chain.